Written by Mrat Hnin Wai

Border News Agency

Mrauk-U, July 14

In the final phase of the Arakan War, the Arakan Army has completely taken control of 15 townships and is now implementing administrative mechanisms under the banner of the Arakan People’s Revolutionary Government.

Locals say that the Arakan Army, through the Arakan People’s Authority, has already established a tax department and started collecting taxes from the public.

Every government exercise administrative power to collect taxes in order to carry out functions such as administration, judiciary, public health, education, national security, public safety, and rule of law. Taxes are also used to pay the salaries of public servants.

In addition, taxes are collected to build essential infrastructure such as hospitals, clinics, schools, roads, bridges, airports, railways, and electricity systems. Taxes are also collected to demonstrate a government’s legitimacy and political authority.

After capturing towns, the Arakan Army has formed a revolutionary government and, according to locals, established customs and tax departments at central, district, and township levels, increasing efforts to collect taxes.

In addition, locals say that other departments and organizations are also collecting separate taxes. There is also a “National Fund” being collected under a voluntary contribution system, where people can donate any amount without a fixed rate.

Locals say that the customs and tax departments are collecting various township-level taxes, including water tax, fire safety tax, municipal sanitation tax, house tax, shop tax, and motorcycle tire tax (wheel tax).

Additionally, they say that traders involved in goods trading are being charged trade taxes, internet users are paying internet usage tax, and other taxes such as sales tax and shop tax are also being collected.

Although the central tax department has set standard rates for these types of taxes, locals report that the actual amounts collected vary depending on the location and region.

“In our area, house tax depends on the type of house. For a regular house, it’s 2,000 kyats, and for an apartment, it’s 6,000 kyats. Except for house tax, all other taxes are fixed at 6,000 kyats each. Every tax must be paid in two installments within a year,” a woman from Pauktaw Township told Border News Agency.

Locals say that each household has to pay 5,000 kyats annually for house tax. Water tax is 3,000 kyats per month, sanitation tax ranges from 3,000 to 6,000 kyats per month, fire safety tax is 1,500 kyats per month, and shop tax ranges from 10,000 to 30,000 kyats per month depending on the type of business.

In addition, traders say they are required to pay a trade tax amounting to 3% of the total value of goods imported into Arakan.

Although trade tax and house tax are uniform across all townships, locals say that water tax and sanitation tax are typically 5,000 kyats, but in Myaybon town, people had to pay up to 6,000 kyats.

“They probably reduced it because people were saying 6,000 was too much. It’s been a month since the reduction,” said a man from Myaybon town.

However, after rising public criticism, locals say the sanitation tax in Myaybon town has been reduced to 3,000 kyats.

Traders say that the Arakan Customs and Tax Department is collecting up to 10% in taxes on timber, including hardwoods exported to neighboring countries, as well as on buffaloes, cows, and pigs.

In addition, locals report that in some cases, up to 30% tax is being collected, along with limitations on the number of people allowed to operate in certain trades.

However, in some townships, locals say tax exemptions were granted for the first five months before tax collection officially began.

“At first, there was a five-month tax exemption. During that time, except for major traders who imported large quantities of fuel and medicine, locals were exempt from taxes. After the five months ended, house tax, land tax, business tax, and water tax began to be collected. Taxes are collected for the entire year,” said a resident of Taunggoke town.

In the areas controlled by the Arakan Army, shop owners say they are being charged shop taxes, and in some townships, the taxes have increased, according to shopkeepers.

Shop owners say that shop tax is collected annually based on the type of shop, with small shops paying 10,000 kyats and larger shops paying up to 20,000 kyats.

“In the town center, we pay a municipal tax of 5,000 kyats, but no house tax. In the outskirts, we pay annual taxes, small shops pay 10,000 kyats, and larger shops pay 20,000 kyats. They say the tax is necessary for reconstruction efforts,” said a shop owner from Kyauktaw town.

The Arakan Customs and Tax Department needs to set clear tax rates according to the types of goods to be taxed, and locals say these rates should be publicly and transparently displayed.

Even if there are difficulties in officially announcing them due to security and other issues in the Arakan region, locals say it is necessary for the department responsible for tax collection or for the public to have written notices posted that clearly show the areas, goods, and tax rates being applied.

Legal experts say that clearly documenting and collecting taxes in this way can prevent misunderstandings, misperceptions, and the dangers of arbitrary taxation.

Additionally, locals say it is necessary to coordinate and unify tax payments and tax receipts for goods imported from abroad at border points or designated locations so that these documents are recognized throughout all areas controlled by the Arakan Army.

People living in towns under Arakan control say they normally pay around 10,000 kyats in taxes per month.

Although the Arakan Army controls 15 townships, administrative functions are regularly operated in only 10 townships, with about 50,000 households, according to data from the General Administration Department.

Some officials of the Arakan People’s Revolutionary Government say that they roughly estimate to collect around 500 million kyats per month in taxes from the people.

Some officials of the Arakan People’s Revolutionary Government say that the estimated 500 million kyats collected monthly comes from water tax, garbage tax, house tax, and fire safety tax, but does not yet include revenues from shop tax, internet tax, trade tax, sales tax, or fees from issuing certificates.

Shop owners say that small household shops, convenience stores, phone shops, and clothing shops have to pay taxes ranging from 10,000 to 30,000 kyats for six months’ worth of payments.

“A shop that makes sales can afford to pay, but small household shops that don’t sell well are burdened,” said a household shop owner from Pauktaw Township.

Some officials of the Arakan People’s Revolutionary Government confirm that internet service revenues amount to about 1 billion kyats per month.

In the areas controlled by the Arakan Army, there are at least ten locations where paid internet access is available, generating monthly revenues ranging from 10 million kyats to nearly 100 million kyats per site, according to some Arakan government officials.

“One agent has to pay 450,000 kyats per month. Internet users also pay the agent, who in turn pays the Arakan government,” said a resident of Kyauktaw area.

Locals say that the internet services are managed and overseen by the Technology Department of the Arakan People’s Revolutionary Government.

Locals say that the Technology Department provides internet services to the public in some areas by township, charging between 3,000 and 20,000 kyats per hour.

People pay for internet usage by the hour, and money transfer agents say they have to pay monthly fees and annual taxes to continue operating, according to locals.

“Around Kyauktaw, the prices are the highest. Half an hour costs 10,000 kyats. Using it for about three hours will cost you 30,000 kyats,” said a local resident of Kyauktaw.

Although the Technology Department directly oversees internet services, in some areas there are arrangements where monthly fees are collected and permission is granted to operate, according to reports.

However, locals say that internet tax rates vary by township, and the Arakan People’s Revolutionary Government allows only its members, their families, and close associates to operate the services.

People say that in townships under Arakan Army control, satellite internet Starlink services are used to provide internet access, with fees charged for usage.

Additionally, locals say that when they go to the offices of village chiefs, township administrators, or area commanders to request recommendation letters, they still have to pay fees.

They say that a letter for a travel permit costs between 1,000 and 10,000 kyats.

Locals say that the amount of money paid for these permission letters varies not only between different township offices but also from one district office to another.

Those paying these taxes wonder whether all the collected funds fully reach the treasury of the Arakan People’s Revolutionary Government, and some have expressed doubts about this.

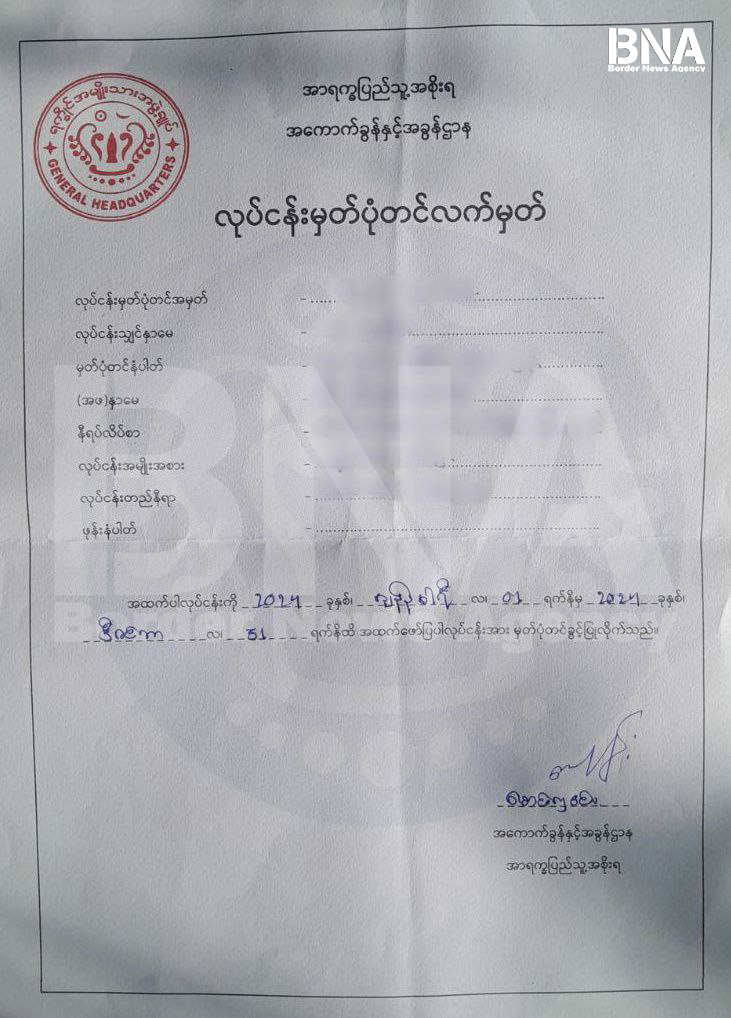

Locals report that in some townships; the tax receipts they receive lack official stamps from the tax department and are merely ordinary photocopied paper slips from copy shops.

Moreover, some say that instead of collecting taxes according to the amounts set by the central tax department, there are cases of increased and excessive tax collection, making it difficult for the people to trust.

“A lot of the money probably won’t reach the top. There may be some embezzlement. There are many rumors going around saying that. I’ve also heard that some people lost their positions because of tax embezzlement,” said a local from Minbra.

To prevent such cases of excessive tax collection and embezzlement, the people paying taxes are demanding that the tax amounts to be collected be presented openly and transparently. They also call for thorough investigations and effective actions against those who commit tax fraud.

Among the Arakan People’s Revolutionary Government, the public emphasizes the need to pay special attention to preventing any misuse of the taxes that are being paid faithfully amid the hardships faced by the people.

Moreover, the people say it is necessary for tax amounts to be consistent and fair across different townships.

“It’s important not to play favorites between the influential and the ordinary people. Some businessmen even receive tax exemptions,” said a merchant from Kyauktaw town.

The people affected by the conflict, including war refugees, are still unable to properly resume their social and economic lives and continue to face difficulties in meeting their basic needs, the public says.

Although taxes are being collected from the people for the purpose of Arakan’s restoration, the public says that the official tax rates have not yet been formally announced.

Taxes are important for nation-building, but the people say that the amount should not be burdensome, and the tax collected should be matched with services that are fair and worthwhile.

If there is no fairness in tax amounts, if the taxes become a heavy burden on the people, or if public tax funds are misused, the people warn that public trust and support will not last in the long run.

Comments 7

vwyg8q

770xrj

Tại đăng nhập 188v, người chơi có cơ hội trải nghiệm một thế giới cá cược thể thao phong phú với nhiều môn thể thao hấp dẫn như bóng đá, bóng rổ, tennis và đua xe. Hệ thống cá cược thể thao của nhà cái này không chỉ đơn thuần cung cấp các lựa chọn cá cược mà còn mang đến cho người chơi những loại kèo cược đa dạng, từ kèo châu Á, kèo châu Âu cho đến các kèo cược theo hiệp, giúp người chơi có nhiều sự lựa chọn phù hợp với sở thích và chiến lược cá cược của mình.

ưu đãi 188v – Cơn lốc mới trên bản đồ giải trí trực tuyến 2025, hứa hẹn khuấy đảo cộng đồng cược thủ yêu thích sự đẳng cấp và đổi mới. Đây, là điểm đến lý tưởng cho người chơi tìm kiếm cơ hội làm giàu, là biểu tượng cho xu hướng cá cược thời đại mới.

I like what you guys are up also. Such clever work and reporting! Carry on the superb works guys I¦ve incorporated you guys to my blogroll. I think it’ll improve the value of my website 🙂

Good day very cool web site!! Man .. Beautiful .. Superb .. I’ll bookmark your web site and take the feeds additionally…I am happy to find numerous helpful information here within the post, we’d like develop more techniques in this regard, thanks for sharing. . . . . .

I always was concerned in this subject and still am, appreciate it for putting up.